If the a financial obligation government plan was set up during required borrowing from the bank counseling, it needs to be filed towards judge

by Giovana on maio.26, 2022, under japan

Which chapter of Personal bankruptcy Password offers adjustment out-of expense of individuals having regular money. Part thirteen lets a borrower to store assets and you can shell out debts over the years, usually less than six ages.

Background

A chapter 13 bankruptcy proceeding is even named a salary earner’s bundle. It permits people who have typical earnings to grow a plan to pay off all otherwise section of its expenses. Less than it section, debtors propose a fees propose to make payments so you can creditors over three to five decades. If the debtor’s newest month-to-month income was lower than brand new relevant condition average, the plan might possibly be for a few age until this new court approves a longer period “to own bring about.” (1) When your debtor’s most recent month-to-month money try more than the applicable condition median, the plan essentially must be for 5 years. In no situation get a strategy permit costs more than a great months more than 5 years. 11 U.S.C. 1322(d). During this time the law prohibits creditors out-of doing otherwise persisted range perform.

It chapter discusses half dozen regions of a part thirteen continuing: the great benefits of choosing chapter 13, the fresh new part thirteen eligibility standards, exactly how a section thirteen continuing functions, putting some plan work, together with unique chapter thirteen launch.

Benefits of Chapter thirteen

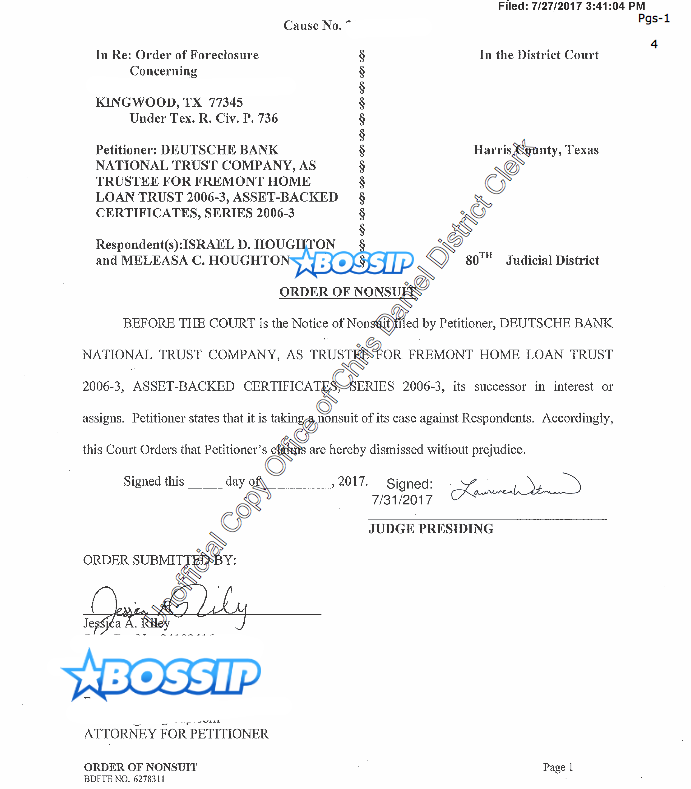

Chapter 13 now offers some one a number of benefits over liquidation not as much as a bankruptcy proceeding. Maybe most especially, chapter 13 even offers people the opportunity to cut their homes from property foreclosure. Because of the processing around it part, individuals can also be stop foreclosures legal proceeding and may dump unpaid mortgage repayments through the years. Nonetheless, they need to however generate all mortgage payments that can come owed through the new section 13 plan on day. Another advantage regarding section thirteen is the fact permits people to reschedule shielded expenses (other than a mortgage due to their first house) and extend him or her along https://getbadcreditloan.com/payday-loans-vt/ the lifetime of the fresh new part thirteen bundle. Performing this get lower the money. Section 13 has also another provision you to definitely protects third parties who will be accountable toward borrower on the “user bills.” This provision will get manage co-signers. Ultimately, part thirteen serves particularly an integration financing around that the personal makes the bundle money to help you a chapter thirteen trustee who up coming directs costs to help you financial institutions. Individuals will have no head connection with loan providers when you’re lower than part thirteen security.

Section thirteen Qualification

Any person, no matter if worry about-working otherwise operating an enthusiastic unincorporated business, is approved for part 13 recovery for as long as the individuals un-secured debts is actually lower than $394,725 and you will secure debts is actually less than $1,184,two hundred. eleven You.S.C. 109(e). These types of numbers try adjusted sometimes to help you mirror alterations in an individual rates list. A company or relationship may not be a section thirteen debtor. Id.

Just one never file not as much as chapter thirteen and other part when the, into the before 180 months, a past bankruptcy petition is dismissed as a result of the debtor’s willful incapacity to appear until the judge or adhere to requests out-of the latest legal otherwise is willingly dismissed immediately following financial institutions looked for relief from the new personal bankruptcy legal to recuperate possessions upon which it hold liens. eleven You.S.C. 109(g), 362(d) and you can (e). As well, nobody could be a borrower lower than chapter thirteen otherwise people part of your own Case of bankruptcy Code except if they have, in this 180 days before filing, obtained borrowing guidance out-of a prescription credit counseling company in a choice of just one or category briefing. 11 You.S.C. 109, 111. Discover exceptions inside the crisis situations or the spot where the U.S. trustee (otherwise case of bankruptcy administrator) features determined that there are decreased accepted businesses to own called for counseling.